Home » Posts tagged 'Wages'

Tag Archives: Wages

Debunking the Myth that It’s Your Fault You’re Poor

by Brian T. Lynch, MSW

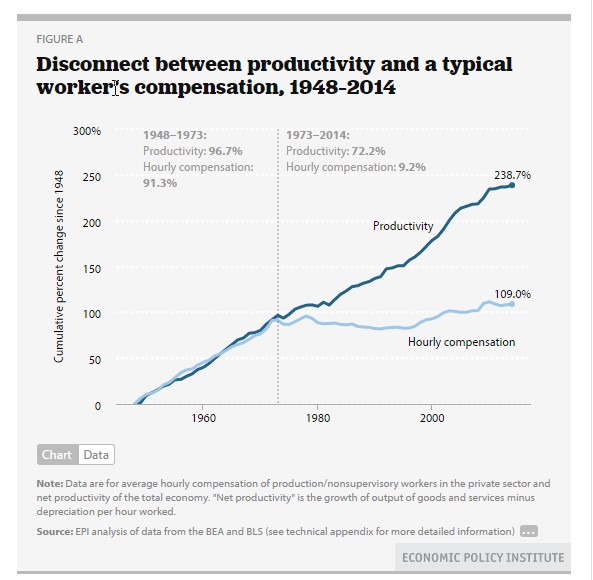

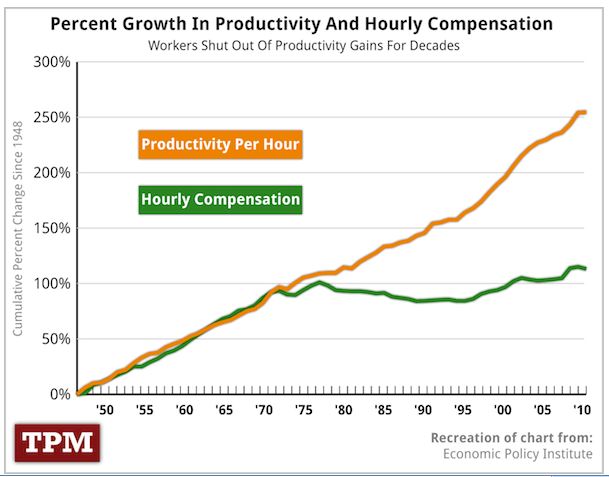

The first time I saw a version of the graph below, depicting how worker compensation suddenly diverged from national wealth, I was horrified. My statistical training caused me to see right away that something took place in the mid-1970’s to stifle the rise of worker compensation. And the gap between wages and wealth keeps growing every years. I have written several articles about it since, but the implications have still not penetrated our public awareness.

The most recent appearance of this graph was from a report by the Economic Policy Institute confirming some earlier findings of the huge disconnect between worker productivity and worker compensation. I wrote an article summarizing their findings and received a lengthy comment that read, in part:

“Although I agree that the average wage is trending lower than productivity growth, I do not attribute it all to the greed at the top… The question I have is that how much of the deviation from the past are due to changes in society, where the average person has less room to negotiate a better price?”

The commentator went on to suggest the following reasons to explain the growing wage-to-wealth gap:

1. The trend of the two paycheck family led to a weakness in the labor force’s ability or need to demand higher compensation.

2. Expanded social service programs and income eligibility caps aid to the working poor created incentives for workers to keep their compensation low so they qualify for government assistance.

3. Employer fixed benefit packages reduced competition for the affordable healthcare, driving up insurance costs since individuals were not “shopping around” for competitive bargains.

Let’s begin with the last point; fixed healthcare benefits. If these were anti-competitive purchases by employers, the rise in employer costs for these programs would correspondingly raise, not lower, hourly worker benefits. The more an employer pays for employee health insurance, the higher the wage compensation is per worker.

Healthcare costs have risen faster than inflation. The reasons for this are many, but the topic is too broad to address here except to say that higher insurance costs led many employers to drop healthcare coverage for their employees. This is a factor contributing to the lower growth in wage compensation. Note, however, that the flood of individuals entering the private health insurance market corresponds with the period of high rising premiums, not lower rates. The collective bargaining leverage of large corporations for competitive health insurance bids was actually a constraining factor on policy costs.

1. The trend of the two paycheck family led to a weakness in the labor force’s ability or need to demand higher compensation.

To the main point, the impact of two paycheck families on wage compensation: Is there evidence that the gradual transition to two paycheck families contributed to lower hourly wage compensation? I believe the graph above provides the answer.

First, the wage/wealth graph above represents actual, verifiable economic data collected over a span of seven decades. It is not a trend graph, but you can easily imagine superimposed trend lines on it. The first would be a linear line rising steadily upward and to the right representing hourly Gross National Product (GDP). This is a measure of our nations’ wealth and it has been steadily growing.

The second trend line, representing hourly wage compensation, would rise perfectly in step with GDP from 1947 to 1973 (which is also the period of rapid expansion of the American middle class). Then it bends sharply (if somewhat erratically) over a seven year period before settling back into to a straight, but much shallower trend line.

Superimposing a trend line on worker compensation data reveals that there was a brief transition period from 1973 to 1980 during which the growth rate of worker compensation radically changed. The gap between new wealth and wage compensation has grows wider every year since.

What does this mean? It means the social forces that altered wage compensation began abruptly and remained active over a brief period of seven to eight years. The social forces created a persistent structural change in America’s hourly wage compensation that remains in effect today. It means that long term social trends don’t account for this structural change because they don’t fit the data.

Long-term trends present as long slow arches rather than sudden bends in a trend line. This means that the social actions that permanently altered the wage and productivity balance happened quickly and none of the major social trends happening before or since the transition period have had much impact on wage compensation.

The hypothesis that this change was the result of the rise of two paycheck families doesn’t fit this pattern. Woman entering the workforce would have had to started abruptly in 1973 and end by 1981. Of course we know that woman were entering the workforce much earlier and the trend wasn’t complete by 1981. It is also difficult to imagine how this phenomenon would actually cause a persistent structural change in worker compensation over the decades.

The relatively brief transition, represented in this graph, also rules out other long term trends that are often cited by economists as reasons for lower wage compensation. For example, it’s often said that globalization of our economy accounts for the wage/GDP disparity. It is true that globalization affects employment rates and puts downward pressure on American worker incomes, but the trend itself is also a longer, slower process that doesn’t fit the pattern. Even the process of shipping business operations overseas took place over a longer period of time. None of the explanations offered by most economists seem to fit the narrow window in which hourly GDP and hourly wage compensation diverged.

Seven years is a short period of time to bring about such a persistent structural change of this magnitude. Something big must have been happening at the time. What was it?

Consider what was happening in the 1970’s. This was a hyperactive period for Nixon era conservatives which gave rise to the new conservative movement, also known as the Neo Con’s. They laid the groundwork that swept Ronald Reagan into office in the 1980.

This was a time of rapid formation of organized business associations and industry trade groups. This was unprecedented in our history. It was the business answer to the growing influence of organized labor. These associations and trade groups pooled the considerable resources of big business to create the powerful business lobby we have today. They embarked on a massive anti-union marketing blitz to demonize unions and turn public sentiment against them. In 1973 the organized muscle of the newly formed corporate lobbyists got congress to pass legislation creating political action committees (PACs) which gave big business a means to funnel large sums of money into candidates political campaigns.

At the same time, the coordinated collision of big business, with a nod from business funded politicians, weakened the effectiveness of collective bargaining. Businesses everywhere were emboldened to end the practice of sharing their profits (wealth) with their employees.

In a span of less than a decade nearly all productivity raises ended for most Americans. All the new wealth (profits) generated since then have gone to top executives and wealthy business investors. The “raises” most employees received since this structural changes were merely cost of living adjustments.

Adjusted for inflation, most American families are making today what their parents family made decades ago, yet the nation’s wealth has more than doubled. The median income of a family of four today is around $51,000 per year. It would be over $100,000 per year if wage compensation had continued to rise proportionally with the wealth we produce.

2. Expanded social service programs and income eligibility caps aid to the working poor created incentives for workers to keep their compensation low so they qualify for government assistance.

Regarding the second point about (#2), expanded social services and income eligibility caps creating a disincentive to work: I have addressed this topic in previous articles. This disparaging of social supports for the economically disadvantaged echoes a frequent conservative talking point. It goes by many names, such as the “welfare state” or the “nanny state. ” It promotes the idea that there is a giant dependency on social welfare programs.

But this attack on working families distracts from the fact that a growing number of people require government aid to the working poor to maintain basic stability. Their plight is a direct result of lower worker compensation caused by premeditated structural changes in the 1970’s. It hides the fact that subsidized assistance to working families allows corporations to have lower labor costs and higher profits. (A government supported labor force is a hidden corporate subsidy.) It dismisses the power of higher wages as a motivation for people to work hard and inspire hope for a better life. It obscures the fact that many companies have found ways to exploit the poor to profit off taxpayer subsidies. Most disturbingly, it blames this suppressed wage compensation on its economic victims.

For a fuller explanation of lower wages on social services, please read “Making the Case for a Living Wage.” http://aseyeseesit.blogspot.com/2012/07/making-case-for-living-wage.html

America Workers Needs a Raise!

by Brian T. Lynch, MSW

The growing gap between the economy on Main Street and Wall Street, a declining standard of living, the shrinking middle class, the rise in the need for government subsidized supplemental income and social services for so many, the sense that our children won’t be better off than we are today, all of this has a common origin. They are all connected! They are all the result of wage stagnation (or suppression as I see it.)

In the period of just a few short years, beginning in 1973, employers stopped giving workers productivity raises. Since then, almost all the raises workers have received were merely inflation adjustments, not rewards for their growing productivity. All those rewards suddenly went to those at the top. The effects of this on the economy are compounded over time. Forty years of this nonsense has brought us most of the economic ills we experience today.

The fact that “growing the economy” no longer results in rising worker compensation has been lost on politicians in both political parties. In fact, almost every policy initiative to “grow the economy” has made matters worse. It has often meant slashing taxes for the wealthy (trickle down theory), granting tax breaks for big businesses, and creating tax loopholes for the “job creators” so they can do their thing. Well, their thing is to get substantially wealthier. Almost all new wealth has gone to the top while the wealthy hide more and more of their assets in tax havens. State and local governments can hardly manage to patch up the potholes on our streets because of the combination of tax breaks for businesses and subsidies for the expanding numbers of working poor families.

The Economic Policy Institute has released yet another report on why most of us are not feeling the love from the Wall Street economy. I have take liberties with their findings to condense them a bit so their impact is clearer.

The Economic Policy Institute has released yet another report on why most of us are not feeling the love from the Wall Street economy. I have take liberties with their findings to condense them a bit so their impact is clearer. For the full report, go to:

Understanding the Historic Divergence Between Productivity and a Typical Worker’s PayWhy It Matters and Why It’s Real

By Josh Bivens and Lawrence Mishel | September 2, 2015

Here is my summary of their summary of findings:

- From the end of World War II until the mid-70’s, inflation-adjusted hourly wages and benefits rose in step with increases in our growing hourly GDP, which measures our economy-wide productivity. This parity between wages and productivity created the middle class.

- Since around 1973, hourly compensation has not risen with productivity grown. In fact it almost stopped very abruptly. Net productivity grew 72% between 1973 and 2014 while inflation-adjusted hourly compensation for most of us rose just 8.7%.

- America’s Net productivity grew 1.33%annually between 1973 and 2014 while hourly worker compensation grew at just 0.20%. Since 2000, the gap between productivity and pay has risen even faster ( 21.6% from 2000 to 2014 vs. just 1.8 % rise in inflation-adjusted compensation).

- Since 2000, more than 80 % of the gap between a typical worker’s pay growth and overall net productivity growth has been driven by rising inequality. Between 1973 and 2014, rising inequality explains over two-thirds of the gap between productivity and worker compensation.

- If the hourly pay of typical American workers had kept pace with rising productivity since the 1970’s, there would have been no rise in income inequality during that period.

- Our rising productivity in recent decades provided the potential for substantial growth in wages for most American workers but this new wealth went instead to the riches segment of society.

- Policies to encourage wage growth must not only encourage productivity growth (the “we must grow our economy” argument) but also restore the link between economic growth wage compensation. Just growing the economy by itself doesn’t fix the economy for most working Americans.

Finally, economic evidence shows that the rising gap between productivity and pay is unrelated to the typical worker’s individual productivity, which has also been rising.

For the full report please go to: http://www.epi.org/publication/understanding-the-historic-divergence-between-productivity-and-a-typical-workers-pay-why-it-matters-and-why-its-real/?utm_source=Economic+Policy+Institute&utm_campaign=019280809d-EPI_News_09_04_159_4_2015&utm_medium=email&utm_term=0_e7c5826c50-019280809d-57319413#introduction-and-key-findings

Should Living Wage Minimums be Based on Individuals or Families?

by Brian T. Lynch, MSW

Question: In looking at the Living Wage calculator, I see that $10.83 for a single adult in Morris County, New Jersey where I live. This seems fair to me for a single person, but when you add one child to that scenario the rate jumps to $22.12 per hour. This raises a serious question. Does the Living Wage Movement suggest that wages should be adjusted according to need? [ http://livingwage.mit.edu/ ]

Answer: That’s a great question. I am not a spokesman for, or advocate of, the living wage movement as an organization. I do believe that living wages should be the minimum wage in this country. Minimum living wages should be what we pay summer college help or student interns, not full-time employees. It might also be appropriate for part-time seasonal help. It shouldn’t be what we pay permanently hired employees.

To answer your question, I researched what a living wage is in the 130 cities that have living wage laws. It turns out that their wage base is for a single employee, not including any dependents. A living wage in Manchester CT equals $15.54/hour (the highest) while it is $8.50 in Orlando FL (the lowest). It would appear that the Living Wage Movement is looking to index a minimum living wage minimum to local economies based on one adult with no dependents.

That said, the minimum wage in 1986 was $10.86/hour as opposed to its current level of $7.25/hour. If it had been indexed to inflation in 1986 the current minimum wage today would be $23.59/hour today. That clearly was intended to provide for a worker with a family. The current median family size is 2.54 persons per household. That inflation adjusted wage equals about $47,000 per year while the current median family wage is a little over $51,000 per year (and still declining, I might add).

Here’s the thing, we have only been talking about wage adjustments to keep pace with inflation. We have not been talking about raising wages to reward workers for our growing productivity. We have not been talking about sharing the wealth that workers help create so everyone keeps pace with America’s growing economy. Cost of living adjustment are important, but they shouldn’t be confused with a productivity, or merit raise.

America is $1.7 trillion richer today than it was in 1976. Our economy has doubled, yet the share of all that new wealth created by American workers in this same period of time is insignificant.

In the 1960’s my father was an appliance repairman at Sears. His salary was enough that my mother could stay home to raise my sister and me. Her role as mother to the next generation of citizens was valued. Today, a typical family of four making about $51,000 does so because both parents work. And they are only able to make ends meet because of easy access to credit to shift their financial burdens onto their future earnings.

When I speak about a living wage I am thinking about getting back to a point where one breadwinner can hold one full-time job and still raise a small family without needing government assistance to do it. That’s what we had, and that should be our goal as a country.

Minimum Wage is a Moral Question

by Brian T. Lynch, MSW

The White House put out a brief video on why we should raise the minimum wage to $10.10/hour. It is OK as far it goes, but it is still a little disappointing to me.

Click here to see the video. [ https://www.youtube.com/watch?v=PqtLQgkcUFM ]

Even the White House is looking at minimum wage law though the modern day pro-business bias that has infected all of civil government. Even though raising bottom wages creates an economic stimulus that would boost spending, increase demand for goods and services and create more jobs, this isn’t the most important aspect. The main reason to raise minimum wages is because it’s simply the right thing to do.

The question of minimum wage is actually a moral question. There is no good rationale for paying a full-time employee less than a self-sufficient wage. What is almost half of a human beings waking moments worth? What is the minimum compensation they should receive for devoting that time to enrich their employers? Why should it be less than what is required to survive with human dignity?

From a social perspective, should profitable businesses be held in high esteem as models of efficiency for paying wages so low that full-time employees require taxpayer subsidy to keep from becoming homeless or having their children taken away from them? Should we have to subsidize the labor force of wealthy corporations like Walmart? Should the federal income taxes of those who make more than minimum wage have to be used to supplement the other employees who takes out the trash at night or mow the lawn? Why should any healthy corporation be allowed to boost their profits at public expense through subsidized labor?

If small businesses or start-up company need government subsidies or tax breaks to help pay their help, let these business owners apply for government assistance rather than make their employees feel inadequate by having to beg for government assistance. No man or woman who works hard all day long should have to apply for housing assistance or SNAP or KidCare or childcare assistance or HEAP or any other government subsidy. Let the business owners apply for government aid to help pay employees the self-sufficient wages all full-time workers should have. Let the means testing process for government subsidy programs fall to the employers. Let’s get it off the backs of the working poor and eliminate the social stigma they don’t deserve. Let the minimum cost of self-sufficient labor wages be part of the cost of doing business in America.

Profits for CEO’s and share holders should not come before self-sufficient wages for laborers. Exploiting workers and taxpayers to boost profits for investors and chief executives is immoral.

Inequality on a Global Scale (literally)

The cartoon below is from the great editorial cartoonist Stuart Carlson. It highlights with humor a very serious global economic condition, growing wealth inequality.

http://www.gocomics.com/stuartcarlson/2014/06/20#.U9Zns_ldXfJ (Go and enjoy his other cartoons.)

Allow me to breakdown the math for you. These figures work out to an average of $486 per poor person vs. $20 billion per rich person. This is not a measure of income but a measure of wealth, or capital.

Another important math fact from this illustration: If you have $20 billion in capital and earn an average return on investments of 4% a year, and if you lavishly spend $1 million per month on your lifestyle, at the end of 50 years you will still have $140 billion left for your children to inherit. That’s right, if you have seven children they would each get close to the 20 billion that you started out with.

This is the crisis of capital that we face. This fact is among the findings of economist Thomas Piketty in his recent book, Capital in the Twenty-First Century. Within just a few generations almost all the wealth on the planet will be handed down from parents to children. Almost no new fortunes will be made through the earnings of those who have to work for a living. We will effectively return to a feudal system even here in the United States and abroad. The phenomenon is global. The quicker national and global population stabilize or decline the faster wealth will concentrate among the wealthy.

All we have to do to return to a feudal society is… do nothing.

Someone on facebook asked me, “Is it really the zero-sum game that these breakdowns of wealth distribution always seem to imply?” Good question! Is it the case that the growing wealth of the wealthy must come at the expense of growing poverty Or, doesn’t the growth of capital lift all ships?

When you look at national and global income-to-capital averages you see what looks like fairly stable ratios. Growing capital wealth and growth in income seem to balance. But look a littler closer and you see that more of the population falls into poverty as the value of capital grows at compounded rates. So yes, there is more national income, but there is an ever larger percentage of income coming from capital investments and going to the wealthy. As capital becomes the main source of income, the real earnings of wage earners stretches and collapses at the lower end of the economic scale. For the middle class, it is like being caught between the gravitational fields of two black holes… one created by poverty and the other by capital wealth

Our Chronic Wage Stagnation, Symptoms and Treatments

by Brian T. Lynch, MSW

Decades of frozen wages relative to our expanding wealth is the root cause of many economic problems. More people falling into poverty, a shrinking middle class, declining retirement savings, increased welfare spending, higher unemployment, more aid to working families, declining government tax revenues, diminished funding for Social Security and Medicare, a sluggish economy (despite a record high stock market), slow job growth and heighten social tensions along the traditional fault lines of race, ethnicity and gender are among the many issues influenced by decades of wage stagnation.

Beginning in the late1970’s most American workers received only cost of living adjustments in their paychecks while their real earnings gradually diminished each year. Employers increased hourly wages to keep pace with inflation, but they suddenly stopped raising wages to reward workers for their productivity. Earned income has declined for most Americans as a percentage of our gross domestic product (GDP) This amounts to a dramatic and intentional redistribution of new wealth over the last 40 years. Nearly all this new wealth has gone to the rich and powerful.

The visual evidence of wage stagnation relative to hourly GDP is apparent in one powerful graph (below). You may have this it before.

SYMPTOMS

The effects of wage stagnation on our economy have been gradual and cumulative. Its impacts don’t raise red flags from one year to the next, but the cumulative effects are obvious. The trending rise in income inequality, for example, was missed entirely for 25 years, and then it still took another decade for it to catch the public’s attention.

According to USDA data on the real historical GDP and growth rates[i], the U.S. economy grew by $368 trillion between 1976 and 2013. That is a 109.4% rise in national wealth, more than a doubling of the national economy. Almost none of that wealth was shared with wage earners. If hourly wages continued to grow in proportion to hourly GDP, as it had for decades prior to the mid-70’s, the current median family income today would be close to $100,000 a year instead of the current $51,017 per year.[ii]

Think about that for a moment, and about all the implications for wage based taxes and payroll deductions. For simplicity sake, let’s say wages would have double if the workforce received productivity raises. That would significantly reduce the number of families currently eligible for taxpayer subsidies such as SNAP (food stamps), housing assistance, daycare and the like. At the same time the workforce would be generating much more income tax revenue.

Consider next the impact wage stagnation has had on payroll deductions. Social Security and Medicare premiums have not financially benefited from the growing economy. Double current wages and you double current revenues for these programs as well. Moreover, the economy has grown at an annual rate of 2.9% since 1976. If Social Security and Medicare had benefited from this new annual wealth, the effect on current revenue projections would be profound. We would not be looking at a projected shortfall any time in the future.

The impact of wage stagnation on consumer spending is perhaps the most insidious problem. While worker wages have stagnated, the production of goods and services has grown. How is that possible? Some of this production is sold in foreign markets, but domestic markets are still primary. And it is here where economic theories have done a disservice.

A generation of economists and business leaders have treated consumers and workers as if they were not one and the same. This has fractured how we look at the economy and given rise to the notion that labor is just another business commodity. It disguises the fact that labors wages fuel consumer spending. Wages help drive the whole economy while wage stagnation reduces consumption over time.

To overcome this effect we have seen the need for mother’s to enter the workforce in mass, and for banks to invent credit cards to bolster consumer spending. These and other creative measures can no longer forestall the decline in worker spending. So while the financial markets ride the tide of America’s growing wealth, the fortunes of those who have been cut off from that new wealth continue to slip beneath the waves.

As for social tensions among different racial, ethnic and gender groups, the effect of stagnant wages relative to the nation’s growing wealth creates a lifeboat mentality and zero sum thinking. For the first time in many generations parents are worried that their children will have less in life than they had. When the whole pie is shrinking a bigger slice by one person means a smaller piece for others. This thinking exists because for over 95% of wage earners the economic pie hasn’t grown in 40 years.

TREATMENTS

You may not be ready to accept chronic wage stagnation as “the syndrome” underlying our economic woes, but it’s also true from my experience that having solutions (or “treatment options”) at hand often makes it easier to identifying the problems they resolve. With that in mind, I want to offer some solutions to America’s low wage conundrum.

One direct approach to raising worker wages is the one currently being discussed in the public dialogue, raising the minimum wage. This benefits the lowest paid workers and also puts pressure on employers to increase pay for other lower wage earners. The current target of $10.10 per hour would still leave many families at or below the poverty line. Workers making the new minimum wage would still be eligible for some public assistance for the working poor. While passing a minimum wage law is at least possible, this option is not a systemic solution to wage stagnation. Even index the minimum wage to inflation would not compensate for declining wages relative to GDP growth.

Another direct approach to ending wage stagnation is to pass a living wage law. This would set the minimum wage at a level that would allow everyone working full-time to be financial independent from government assistance, including subsidized health care. A living wage law could be indexed to the local cost of living where a person is employed. This is idea because it takes into account local economic conditions which are determined by market forces rather than government edict. But passing a living wage law in the current political climate is unlikely.

There are other ways of encouraging wage growth that don’t involve direct wage regulation. One idea would require the federal government to recoup, through business income tax rebates, the cost of taxpayer supported aid to working families from profitable businesses that pay employees less than a living wage. Employee wages are easily identified through individual tax returns. Eligibility for taxpayer supported subsidies are relatively easy to estimate as well, so recouping public funding to support a company’s workforce is a practical possibility. A portion of the recovered money could be paid into Social Security and Medicare to make up for lost revenue due to substandard wages.

A welfare cost recovery plan could gain popular support given the growing public resentment towards taxpayer funded social programs. At least 40% of all full-time employees in America currently require some form of taxpayer assistance to financially survive. More importantly, this plan places the burden of supporting the workforce back on profitable businesses where the responsibility lies.

Another solution has been suggested by former US Labor Secretary, Robert Reich, and others. They support proposed legislation, SB 1372, that sets corporate taxes according to the ratio of CEO pay to the pay of the company’s typical worker. Corporations with low pay ratios get a tax break. Those with high ratios get a tax increase. This would effectively index worker wages to CEO compensation in a carrot and stick approach to corporate taxes. The details and merits of this approach is outlined elsewhere.[iii]

Do U.S. businesses have the financial capacity to offer higher wages to their workers? I would like to answer that question with another graph that you may also have seen before.

Credit: Blue Point Trading http://www.blue-point-trading.com/blue-point-trading-market-view-june-07-2012

There is a clock ticking somewhere in the background on this issue. There is a point somewhere in the future where it will be too late to fix wage stagnation through the normal democratic processes. History has proven this to be true. We are not at that point now, but we are past the point treating wage stagnation earnestly.

______________________________________________________

[i] Link: Real Historical Gross Domestic Product (GDP)

[ii] As of 2013 the median family income of $51,017 x GDP growth of 109.4% = $104,796 per year

[iii] Link: Raising Taxes on Corporations that Pay Their CEOs Royally and Treat Their Workers Like Serfs

Are You Forced to Subsidize Low Wage Workers?

by Brian T. Lynch

According to the NY Times: “As in 2011, 46 percent, or nearly half of New Yorkers, were making less than 150 percent of the poverty threshold, a figure that describes people who are struggling to get by.

Even with fewer people unemployed, the poverty rate for working-age adults working full time reached 8 percent, by the city’s measure. Fully 17 percent of families with a full-time worker lived in poverty, and even among families with two full-time workers, the rate was 5.2 percent.”

NOTE: This means that 8% of adults working FULL-TIME are at or below the poverty line, while 46% percent of all EMPLOYED New Yorkers are struggling to get by. This reinforces my analysis that NEARLY HALF of all working families must rely on some form of PUBLIC ASSISTANCE to make ends meet. Government assistance to these fully employed families = a tax subsidy on labor costs for the companies that employee them.

Put another way, people who earn more are being made to subsidize the company’s low wage employees through their federal income tax withholding. Ordinary wages have been held hostage to the 1% for almost 40 years.

AMERICANS NEED A RAISE

In, “Making the Case for a LIVING WAGE” I discussed more fully why it must be the obligation of business to compensate their employees to a level of at least minimal self-sufficiency (a living wage). Once all wage earners realize they shoulder the burden for low wage workers there will be more activism to at least raise the minimum wage. Ask yourself, “How much does my companies low wage policies cost me in income taxes?”

Here below is the link to the New York Times article which is about New York City, but could be about any city in America.

Prologue To Wealth Inequality Awarness

By Brian T. Lynch, MSW

Before I had a blog, before the Wall Street “privateers of equity” crashed the economy, and long before the Occupy movement occupied anything, there were seemingly crazy folks like me trying to sound the alarm on our economy. I wrote Letters to the Editor in local newspapers and sent copies to every newspapers across the country for which I had an email addresses. What disturbed me back then was that no one in the media, or even in academia, seemed to be paying much attention. Event have consequences, and the crash in 2008 caught us flat footed.

It is unknown how social problems that exist for years suddenly become public issues to be solved. No one knows what triggers these tipping points. Even when a single individual is clearly associated with a change or a movement or a discovery (Einstein, for example), that person is responding to what ever came before. Sometime it is the consequential event rather than any alarm bells that finally get our attention. The firmament that precedes public cognition before a disastrous event remains a mystery to me.

My wife just came across one of my old letters. What startled me is that I could have written this same letter today, except the statistics are far worse now.

Here below is my Daily Record Letter to the Editor published on Christmas Eve, 2006.

Civil Service Pensions – A Marker for What We’ve Lost

In New Jersey, as in many other states with conservative Republican Governors, the state civil service pension systems are under attack. A friend of mine, who has followed Governor Chris Christie’s rhetoric in the newspapers, commented about how reasonable this sounded since the system seems to be going broke. But the story of the pension system in New Jersey is more complicated that the current political sound bites. Let me tell you a true story about how civil service pensions came to be a target for public ridicule.

But things were changing in 1979 when I began my civil service career, even though I didn’t know it at the time. Big business had begun organizing politically and started spending big bucks on lobbying government for laws and regulations more favorable to business. Industry organizations were created to raise money and coordinate anti-union marketing campaigns. Ronald Reagan came into power in 1980 and set the tone for union bashing by crushing the air traffic controllers union. Private sector wages, which up to that time always rose in to proportion to increases in hourly GDP, were frozen and have remained frozen ever since. A fear campaign and actual business tactics based on globalization made jobs less secure. Private company pension systems were intentionally dismantled by big corporations to quarterly boost profits. Profit sharing arrangements took their place initially so workers had to invest in their company for their hope of retirement income. Then Wall Street saw all this money and wanted some action. They got congress to pass the IRA laws and all that pension money went to them.

Instead of real raises, businesses only offered cost of living adjustments, which keeps up with inflation but doesn’t share the extra wealth that the growing hourly GDP created for their employers. That extra wealth went to CEO’s and wealthy stockholders, beginning the cycle of great income disparity we have today. At the same time, Reagan cut the top marginal tax rate from 70% to 28%, a windfall for the rich and a huge loss of tax revenue that the rest of us had to bear.

So while the raises, salaries and benefits I received were always sub-par compared with the private sector during the first half of my career, declining private sector wages and benefits, rather than civil service raises or improved benefits, is the reason civil service looks so good today. In fact, civil service benefits have been steadily eroding for the last 15 years but this decline is slower than the collapse of private sector benefits. Civil service salaries also have barely budged in years and actually declined when you factor in inflation. But the assault on private sector salaries and benefits makes civil service look great by comparison only.

Know this, if corporate business interests had not conspired to suppress wages in America over the last 40 years the median income for a family of four today would be over $100,000/year. Instead it is shrinking and down to $51,000/year.

My point is that people in this country who work in the private sector have to fight back to regain a fair bite of the wealth they create for their employers. Workers need to re-organize and demand their fair share of our GDP. Rather than tearing away at civil servant pensions, people should be working to recreate what has been taken from them and use civil service as the framework and model to rebuild private sector retirement security.

There are particulars about why the pension system in New Jersey is in so much financial trouble. It isn’t because it is too generous. It is in trouble because when New Jersey was flush with money during Governor Christie Whitman’s (R) term she stopped making payments. She said she did this because the stock market was booming at that time. She said the pension system was way over-funded and didn’t need more cash. By the time she finished bankrupting the state with massive tax cuts and increased credit spending, Governor James Florio (D) didn’t have the revenue to pay into the state pension system during his entire term in office. This default model became a habit with subsequent Governors. Nothing, or only fractional amounts, were paid into the retirement system for the last 20 years. Governor Chris Christie (R) refused to put money into the system a few year back, when he had the money to pay, saying he didn’t want to put money into a broken system. This is crazy talk since it was the Executive branch that broke the system in the first place by doing exactly what he was doing.

The New Jersey State Pension system is, to a lesser extent, also in trouble because it has been abused for years by politicians bumping up the salaries of their political cronies just before retirement so they get huge pensions that they didn’t deserve or contribute towards. Politician’s take advantage of the way pensions are calculated to reward their buddies.

Graphic Truths about Debt and Deficits

NATIONAL DEBT?

Republican’s increase our public debt by lowering taxes on the wealthy, raising corporate welfare and starting wars. If you are surprised by this bar graph then you then you need to shop around for a more reliable news source.

WAR SPENDING?

CORPORATE WELFARE?

Corporate Welfare Grows to $154 Billion even in Midst of Major Government Cuts

Editor’s Note: Even as the federal government executes major cutbacks, it’s giving huge subsidies in the form of tax breaks to industry, a fact legislators rarely acknowledge. The Boston Globe recently published a thorough and eye-popping report detailing the nature and extent of these breaks. We think it’s a must-read.

By Pete Marovich

First published in the Boston Globe

WASHINGTON — Lobbying for special tax treatment produced a spectacular return for Whirlpool Corp., courtesy of Congress and those who pay the bills, the American taxpayers.

By investing just $1.8 million over two years in payments for Washington lobbyists, Whirlpool secured the renewal of lucrative energy tax credits for making high-efficiency appliances that it estimates will be worth a combined $120 million for 2012 and 2013. Such breaks have helped the company keep its total tax expenses below zero in recent years.

The return on that lobbying investment: about 6,700 percent.

These are the sort of returns that have attracted growing swarms of corporate tax lobbyists to the Capitol over the last decade — the sorts of payoffs typically reserved for gamblers and gold miners. Even as Congress says it is digging for every penny of savings, lobbyists are anything but sequestered; they are ratcheting up their efforts to protect and even increase their clients’ tax breaks. [snip] http://reclaimdemocracy.org/corporate-welfare-tax-breaks-subsidies/

__________________________________________________

Here is how the rise of corporate welfare looks in my state of New Jersey, and note in particular how it has grown under Gov. Chris Christie: